You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying gold and silver.

- Thread starter Sum1

- Start date

Maddog

★★★★★ Legendary Member

Maddog

★★★★★ Legendary Member

Silver Breaks $40 for First Time Since 2011

Silver broke above $40 an ounce Monday, breaking out to a 14-year high. With a 40% gain year-to-date, silver is leaving gold in the dust as investors bet on imminent Fed rate cuts. The metal briefly touched $40.79 before consolidating, with futures markets pointing to continued strength.The momentum is real — ETF holdings rose for the seventh consecutive month, reaching 800 million ounces in August. That’s the longest buying streak since 2020, suggesting institutional investors are positioning for a sustained move higher.

What’s driving this rally? Silver’s unique position as both an industrial workhorse and a monetary metal makes it a winner whether the economy accelerates or seeks shelter. The gold-to-silver ratio has compressed from 104 in April to just 85, signaling silver’s relative outperformance may have further to run.

I want to be just like Lunk.

But instead of Covid it will be gold/silver.

@lunkerslayer

Keep it coming

Maddog

★★★★★ Legendary Member

BRICS Summit Looms Amid Gold-Fueled De-Dollarization Push

The upcoming BRICS+ summit, set for late October in Russia, could significantly reshape the global monetary order — and gold is at the center of it. With new members like Egypt, Iran, and the UAE already in and heavyweight contenders like Saudi Arabia, Turkey, and Mexico waiting in the wings, the bloc now represents more than 43% of global oil production and a growing share of global GDP. As dollar-reliant trade faces mounting skepticism, BRICS nations are rapidly increasing their gold reserves and exploring settlement systems independent of Western banking rails.The takeaway here is: As geopolitical alliances shift and trust in fiat weakens, gold is emerging as the reserve asset of choice. Central banks aren’t just talking — they’re backing their currencies with bullion, and that trend is likely to accelerate after the BRICS summit.

World Gold Council to Test Blockchain Gold Trading in London

The World Gold Council (WGC) is launching a pilot program to digitize gold trading in London’s massive $900 billion bullion market. The initiative would allow gold to be traded, settled, and used as collateral on a blockchain-based platform, potentially cutting costs. Backers say it could help bridge the gap between physical and digital assets, making gold more accessible to a wider range of investors.While “digital gold” might sound threatening to traditional bullion investors, think bigger picture: millions of new investors gaining easy access to gold ownership could drive unprecedented demand for the physical metal that backs it all.

Digital gold trading could be a game-changer for the precious metals market, bridging the gap between physical assets and the digital economy while potentially boosting demand from tech-savvy investors.

The Quiet Outperformers: Gold and Silver Leave Stocks in the Dust

While everyone’s been focused on the stock market’s recent highs, precious metals have been quietly crushing it. Over the past three years, gold has surged 108% and silver an eye-popping 128%, while the S&P 500 (SPY) has gained a respectable but comparatively modest 68%. Despite the constant headlines about stock market records, it’s actually been gold and silver delivering the real returns for patient investors.Maddog

★★★★★ Legendary Member

Retail Gold Sales Hit 16-Year Lows as China Mandates Massive Institutional Buying

While retail investors have been selling gold and silver for 16 years straight, the world’s largest institutions are quietly positioning for what Mike Maloney calls “a global monetary system reset.” His latest video reveals why this disconnect could represent one of history’s greatest wealth transfer opportunities.

The Retail vs. Institutional Divide

Mike opens with striking data: retail gold and silver sales have declined steadily since 2008, even as prices hit historic highs. Global allocation to gold has dropped to just 0.5%—far below the historical 2% average.Meanwhile, institutions are moving aggressively:

- China now mandates insurers allocate 1% of assets to physical gold, absorbing 15-20% of annual mine supply

- India’s pension funds are drafting rules to allow gold investments

- Indonesia is restricting gold exports to preserve domestic reserves

- Hong Kong investors have tripled gold holdings according to HSBC

The Paper Gold Time Bomb

Mike exposes the most dangerous aspect of today’s gold market: paper leverage. Through “rehypothecation,” one ounce of physical gold can support 100 ounces of paper claims.“The entire gold market is hallucinating that there is a hundred times more gold out there than really exists,” Mike explains. “That means the price is suppressed from where it would naturally be trading.”

If even a small percentage of paper gold holders demand physical delivery, Jim Rickards estimates prices could hit $25,000 per ounce “before an investor could yell buy.” This may explain why Trump’s planned Fort Knox audit was mysteriously cancelled.

Silver’s Extreme Opportunity

While gold dominates headlines, silver presents an even more dramatic opportunity. Using Shadow Stats’ original inflation methodology, silver’s 1980 peak would equal $1,640 today. At current prices around $40, silver trades at just 2.4% of that high.“Look at where it sits. It is an extreme bargain,” Mike emphasizes, explaining why he lets the gold-silver ratio guide his accumulation strategy.

Currency Collapse in Real Time

Mike provides two powerful examples of currency devaluation:Japan: Gold broke 500,000 yen, tripling in five years. With the developed world’s worst debt-to-GDP ratio, Japan’s choice is “print or collapse.”

Venezuela: Mike shows footage of supermarkets pricing everything in grams of gold, with customers paying by weighing gold flakes at checkout. “Historically, real money will win out over government abuse.”

Why This Time Is Different

The evidence suggests this isn’t a normal bull market but a complete monetary restructuring:- Florida legalized gold and silver as money

- Trump’s team explores gold-backed Treasury bonds

- Nations explicitly dump US Treasuries for physical gold

- The dollar has fallen to 1/3,300th of an ounce of gold

Based on logarithmic charts showing previous 2,400% moves, Mike’s analysis suggests $12,000 to $50,000 gold isn’t just possible—it may be conservative if the paper gold system unwinds.

“For heaven’s sake, do not miss it,” Mike warns. While he never recommends buying gold or silver, he shares what he’s doing: accumulating steadily and letting the gold-silver ratio guide his decisions.

@lunkerslayer

Maddog

★★★★★ Legendary Member

Trump Develops New Perspective on Fort Knox Gold

Jeff Mordock | May 26, 2025

(The Washington Times) — The Trump brand has long been associated with gold, but the president suddenly lost interest in the famous U.S. Bullion Depository at Fort Knox, Kentucky.

After a roughly two-week span in February in which President Trump talked repeatedly about traveling to Fort Knox to ensure the nation’s gold is safely stockpiled there, he appears to have abandoned the idea.

Mr. Trump has no plans to visit Fort Knox, The Washington Times has learned.

The decision marks a reversal for Mr. Trump, who, along with his government cost-cutting adviser Elon Musk, raised the issue more than a dozen times in late February, according to a count by The Times.

The White House declined to participate in this report.

Earlier this year, Mr. Trump was preoccupied with the debunked conspiracy theory that someone might have stolen the gold out of Fort Knox and teased plans to personally inspect the fortress.

He mentioned the idea during a White House meeting with French President Emmanuel Macron, with reporters aboard Air Force One, then again in the Oval Office. Mr. Trump also mentioned the idea in separate remarks at the Governors Association and the Conservative Political Action Conference.

“We’re going to Fort Knox, the fabled Fort Knox, to make sure the gold is there. If the gold isn’t there, we’re going to be very upset,” the president told reporters on Air Force One.

Mr. Trump has not broached the idea since Feb. 25.

Maddog

★★★★★ Legendary Member

Why should precious metals investors care? Rate cuts are rocket fuel for gold and silver. Lower rates make these non-yielding assets more attractive compared to bonds and savings accounts. They also tend to weaken the dollar, making metals cheaper for international buyers. Plus, when the Fed cuts rates, it’s often signaling economic worries ahead – exactly when investors flock to safe havens like gold.

Maddog

★★★★★ Legendary Member

Daily News Nuggets | September 8th, 2025 — Gold Soars Past $3,600, Up $1,000 This Year

SHAREHere’s what you need to know about today’s most important economic and precious metals news:

Gold Smashes Through $3,600 as Critical Fed Week Begins

Gold soared to an all-time high Monday, smashing through $3,600 as investors bet on lower interest rates ahead. Spot gold peaked at $3,636 per ounce, extending this year’s remarkable 38% rally.What’s driving the surge? A perfect storm of factors: anticipation of Fed rate cuts, aggressive central bank buying, and persistent economic uncertainty. The milestone extends beyond U.S. markets — in Canada, gold topped CAD$5,000 per ounce, a striking achievement considering the Bank of Canada holds zero gold reserves.

Looking ahead, UBS analyst Giovanni Staunovo predicts gold could hit $3,700 by mid-2026, suggesting this bull run has room to run.

Maddog

★★★★★ Legendary Member

ANZ Bank: $3,800 Gold by Year-End

ANZ Group raised their gold forecast to $3,800 by December, with a potential peak near $4,000 by mid-2026. The Australian bank cites “robust investment demand” as the driving force.With gold already hitting a record $3,674 yesterday and up 38% this year, their forecast doesn’t seem far-fetched. If gold does reach $3,800, that would mean 45% gains for 2025 — crushing nearly every other asset class. The momentum shows no signs of slowing as investors seek safety from currency debasement and geopolitical tensions.

Goldman’s Call: $5,000 Gold “Highest Conviction” Trade

Goldman Sachs just made a bold call: gold is their top commodities pick, with potential to hit $5,000 by late 2026. The investment bank warns that threats to Fed independence could spark higher inflation, tank stocks and bonds, and erode the dollar’s dominance.Their message to investors? Load up on gold as insurance. With political uncertainty mounting and central banks worldwide already hoarding the metal, Goldman sees a perfect storm brewing for precious metals.

Maddog

★★★★★ Legendary Member

Gold Outshines Stocks and Bitcoin in 2025

Gold’s 40% surge this year has left both stocks and Bitcoin in the dust, proving the ancient metal still has modern appeal. While the S&P 500 gained a respectable 10% and Bitcoin climbed 20% despite Trump administration support, gold emerged as 2025’s standout performer.The precious metal has doubled in value over three years, drawing investors seeking stability amid geopolitical tensions. Analysts keep raising price targets as the Fed prepares for rate cuts, suggesting gold’s golden run may continue. In an era of digital assets and AI-driven trading, gold’s dominance shows that traditional safe havens still shine brightest when uncertainty arrives.

Maddog

★★★★★ Legendary Member

Hopefully I don't sound like a broken record.

Just don't want yall not to be forewarned.

Just don't want yall not to be forewarned.

I thinks there’s logic to what you’re saying. However, I work with a guy who said the same thing and bought silver like crazy at the last $38 high in 2011 or whatever. He just got back close to even after 10 years. It has potential but fundamentally what do you see as the difference from now to then? Obviously more debt and world order is changing. Is that enough?

Maddog

★★★★★ Legendary Member

Gold Nears $3,700 as Fed Meeting Begins

SHAREDaily News Nuggets | Today’s top stories for gold and silver investors

September 16th, 2025

All Eyes on the Fed: Near Certain Rate Cuts

The wait is nearly over. The Fed begins its two-day meeting today, with traders betting on the first rate cut since 2020. A quarter-point trim looks all but certain — but there’s still a 1-in-5 chance of a bolder half-point move, according to CME’s FedWatch tool.The real suspense? Whether Powell hints at a single “insurance cut” or the start of a broader easing cycle. The Fed’s shift from fighting inflation to fearing recession has already changed the playbook. That pivot usually unleashes a potent mix for gold and silver: lower rates, a weaker dollar, and stronger safe-haven flows.

And investors aren’t waiting for the press conference — the dollar is already sliding.

Macro Winds Favor Metals: Dollar Weakens Ahead of Fed

The U.S. dollar index slipped to 97.08 this morning, down nearly 4% from a year ago. At the same time, 10-year Treasury yields retreated to 4.04%, about 30 basis points lower over the past month.Falling yields and a softer dollar have historically provided a tailwind for precious metals, as they make non-yielding assets like gold and silver more attractive. With the Fed expected to cut rates tomorrow, this “perfect storm” of dollar weakness and easier financial conditions is already feeding into higher metals prices.

And right now, both gold and silver are testing major psychological levels…

Gold Nears $3,700, Silver Breaks Higher

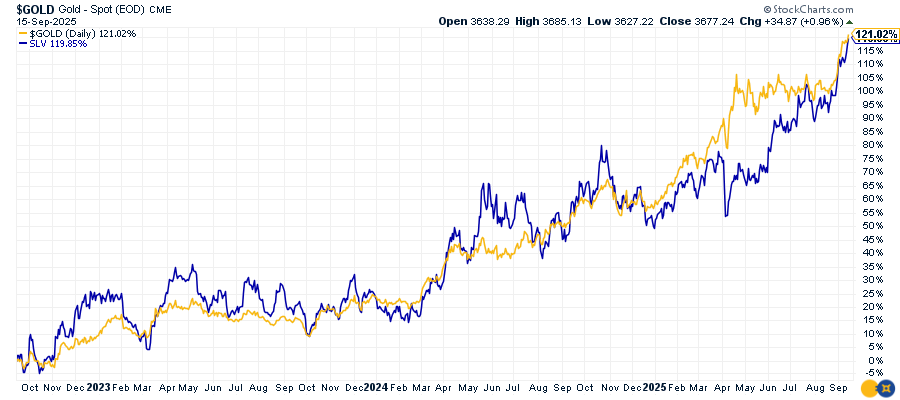

Gold is pressing toward uncharted territory, climbing to $3,690 and testing the $3,700 level for the first time ever. Silver is also gaining ground, approaching $43 an ounce, its highest level in over a decade. The three-year chart below shows just how powerful this move has been:

Gold up 121%, silver up 119%. Both metals have left stocks and bonds in the dust, reinforcing their role as portfolio insurance when uncertainty runs high. With the Fed decision looming today and tomorrow, momentum remains firmly with the bulls.

Silver’s 2025 Rally Is the Strongest in Years

Silver’s 46% year-to-date surge makes 2025 one of its sharpest rallies since the disco era. The catalyst? A perfect confluence of industrial demand from semiconductors and clean energy, dollar weakness, and geopolitical jitters.While impressive, this year’s gains pale compared to history’s legendary silver rallies – 2011’s 83% moonshot and 1979’s epic 267% explosion. But don’t count silver out yet.

Mike Maloney believes the real fireworks begin when silver breaks through $50 – both a psychological barrier and its all-time high. Once that ceiling shatters, he expects silver to rocket into triple-digit territory. The gold-to-silver ratio supports this bullish case, suggesting the white metal still remains undervalued compared to gold historically.

40% Gold: Central Banks Go All-In

Central banks have crossed a stunning threshold: 40% of their reserves now sit in gold vaults, according to Citi’s latest analysis. Most financial advisors would call that concentration reckless – imagine parking 40% of your portfolio in a single asset.But these aren’t rookie investors. These are the world’s monetary guardians, and they’re hoarding gold at unprecedented levels. Why? Years of weaponized sanctions, currency wars, and exploding sovereign debt have shattered faith in paper promises.

This relentless accumulation isn’t just another data point – it’s the bedrock supporting gold’s long-term bull market. When the institutions responsible for national financial security are betting this heavily on gold, individual investors might want to ask themselves: what do central bankers know that we don’t?

Maddog

★★★★★ Legendary Member

Ray Dalio’s Gold Warning Goes Mainstream

Ray Dalio isn’t mincing words about America’s debt problem. The billionaire investor told CNBC that gold and other hard assets will be the clear winners as the U.S. debt burden becomes unsustainable. With national debt topping $33 trillion and no spending restraint in sight, Dalio sees echoes of past currency crises.His point echoes GoldSilver’s long-held view: when governments print their way out of debt problems, smart money moves into assets they can’t print. Coming from the founder of the world’s largest hedge fund, it’s a view that’s gaining serious traction among institutional investors who remember what happened to currencies throughout history.

as we are nearing the end of our knowledge based economy, some predict physical assets and crypto will surge, but no one really knows for sure. Only thing Id bet money on is that things are going to be radically different 5 years from now.

Maddog

★★★★★ Legendary Member

Only thing better is land.

Maddog

★★★★★ Legendary Member

one man's pundits:

The key takeaway? Silver may be one of the most asymmetric bets in today’s financial markets — small shifts in demand could drive enormous moves in price.

As Mike puts it, “We are less than $3 away from silver being in the mainstream media news every day. And when that happens, demand goes exponential.”

Institutions Are Waking Up

Some of the biggest names in finance are already adjusting:- Morgan Stanley has recommended clients liquidate half of their bond allocations and reallocate to gold — a shift that indirectly supports silver’s case.

- Billionaire investor David Baitman pointed out that a $400 million purchase captured only 0.01% of annual gold supply, but the same dollar amount bought 1.5% of silver’s supply. The math highlights just how small — and therefore explosive — silver’s market can be.

Mike’s Bottom Line

Mike Maloney isn’t telling anyone else what to do, but he is clear about his own strategy: he’s buying more silver today. For him, the gold-to-silver ratio still signals value, technicals are breaking out, and supply dynamics suggest a once-in-a-generation opportunity.The key takeaway? Silver may be one of the most asymmetric bets in today’s financial markets — small shifts in demand could drive enormous moves in price.

Final Thought

Silver is already climbing faster than gold and stocks, yet the broader public has barely noticed. With technicals pointing higher, inventories drying up, and institutional money beginning to pivot, the setup is clear: the window to accumulate silver before it hits mainstream mania may be closing.As Mike puts it, “We are less than $3 away from silver being in the mainstream media news every day. And when that happens, demand goes exponential.”

Similar threads

Recent Posts

-

David YT

- Latest: svnmag

-

Bis-Man Reel & Rec Ice Derby

- Latest: Honkerherms

-

YT Squirrel Dog

- Latest: svnmag

-

Crazy Wardens

- Latest: NodakBob

-

Spray foam on steel??

- Latest: 3Roosters

-

Buying gold and silver.

- Latest: 3Roosters

-

I HATE coyotes!!!!

- Latest: bucksnbears

-

OAHE Ice 25/26

- Latest: NodakBob

-

What are you listening to these days?

- Latest: svnmag

-

NFL News (Vikings)

- Latest: Kurtr

-

YT A Real Fisherman

- Latest: svnmag

-

Synthetic e fuels

- Latest: lunkerslayer

-

Online Poker

- Latest: Jiffy

-

Weather 6/20/25

- Latest: risingsun

-

Not Funny #2

- Latest: Davy Crockett

-

Outdoor photo request

- Latest: JMF

-

YT Trout Salad

- Latest: svnmag

-

Uncle Steve's Direction YT

- Latest: svnmag

-

Price of land just keeps going

- Latest: Traxion

-

YT Divorce Eggs

- Latest: Davy Crockett

-

Garmin

- Latest: SDMF

-

Stainless steel frying pans

- Latest: snow2

Friends of NDA

Top Posters of the Month

-

This month: 80

-

- Posts

- 4,692

-

- Likes

- 1,987

-

-

This month: 67

-

- Posts

- 2,940

-

- Likes

- 2,547

-

-

This month: 42

-

- Posts

- 1,424

-

- Likes

- 895

-