You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying gold and silver.

- Thread starter Sum1

- Start date

Maddog

★★★★★ Legendary Member

Steve Hanke: Gold Could Hit $6,000 as Fed Loses Grip

Renowned economist Steve Hanke sees gold climbing to $6,000 in this bull cycle, citing central bank disarray and a weakening dollar. In a wide-ranging interview, Hanke warned that political pressure — especially from Trump-aligned Fed appointments — could accelerate money supply growth and erode Fed independence.Hanke argues that markets are misfocused on interest rates instead of money supply trends, which he sees as the real inflation driver. Hanke also dismissed fears that gold needs a crisis to soar, pointing instead to structural income and monetary shifts already underway.

Why this matters: A loss of confidence in central bank credibility is rocket fuel for gold. If economist Steve Hanke is right, we’re still in the early innings of this gold rally…

Maddog

★★★★★ Legendary Member

gloom and doom

sorry for the posts : )

sorry for the posts : )

Maddog

★★★★★ Legendary Member

Wow:

The Flow Math: Small Percentages, Big Numbers

It only takes a sliver of global capital to transform this market. Consider two lenses:- U.S. near-cash liquidity: Money market funds, demand deposits, currency in circulation, and unused credit lines add up to tens of trillions. A mere 1% rotation would swamp available silver at current prices.

- Global asset base: When you tally global currency, bonds, and equities, you reach on the order of hundreds of trillions. A 1% rebalance into precious metals is measured in trillions, not billions. Silver simply cannot absorb that kind of demand without a step-change in price and, crucially, a shrinking GSR as investors crowd into the thinner market.

“But Won’t the Exchanges Clamp Down?”

They’ll try—because they always do. Expect familiar tactics on the futures complex: margin hikes, tighter position limits, rule tweaks that force deleveraging during sharp moves. These steps can knock price and sentiment around in the short term. Historically, however, policy friction loses against physical scarcity plus real money demand during the terminal phase of a bull market. That’s when the ratio can sprint lower in a hurry.Sentiment, Then Stampede

A revealing anecdote from Mike: in the early 2000s, he was buying silver around $4–$5 and coin shops were empty. Fast-forward to the mid-$40s today and the retail bid is still just a trickle—far from manic. The stampede tends to arrive after new highs and breathless coverage. If history rhymes, that’s when monetary demand collides with a thinned-out float and the GSR reprices in weeks, not years.If we see gold and silver prices that high the last thing people are gonna be thinking about is gold and silver. They will be wondering how they’re gonna feed there families.

Maddog

★★★★★ Legendary Member

Maddog

★★★★★ Legendary Member

Civil unrest?If we see gold and silver prices that high the last thing people are gonna be thinking about is gold and silver. They will be wondering how they’re gonna feed there families.

More . . . .

Maddog

★★★★★ Legendary Member

Note Russia. War vs gold.

Notice, not USA . . . We are too clever ... LOL

Maddog

★★★★★ Legendary Member

Central Banks Are Quietly Rewriting the Global Monetary Order

While silver’s physical market tightens, central banks are making history. For the first time since 1996, foreign central banks now hold more gold than U.S. Treasuries.That’s not a coincidence — it’s a signal.

As Mike and analyst Tavi Costa explain, we’re witnessing the beginning of the biggest global monetary rebalancing in history. Distrust in the dollar is growing, and nations are shifting their reserves from paper promises back to real money — gold.

Gold now represents roughly 15% of global reserves, the highest level in three decades… and climbing fast.

Maddog

★★★★★ Legendary Member

from above:

..... foreign central banks now hold more GOLD than U.S. Treasuries ......

first time since 1996

That should tell y'all something

Recall also that US debt is at record high . . .

Hmmmm. Wonder where gold is headed (meaning the price).

When the s*** hits the fan.

Hopefully one doesn't have their head stuck in the sand yet . . .

..... foreign central banks now hold more GOLD than U.S. Treasuries ......

first time since 1996

That should tell y'all something

Recall also that US debt is at record high . . .

Hmmmm. Wonder where gold is headed (meaning the price).

When the s*** hits the fan.

Hopefully one doesn't have their head stuck in the sand yet . . .

Maddog

★★★★★ Legendary Member

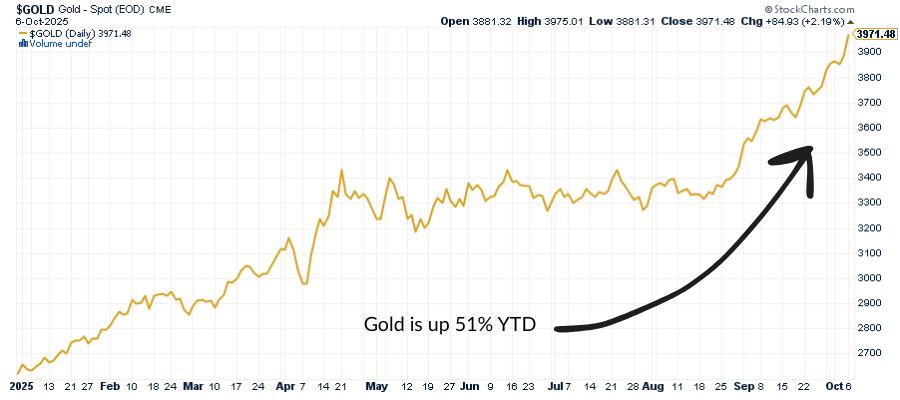

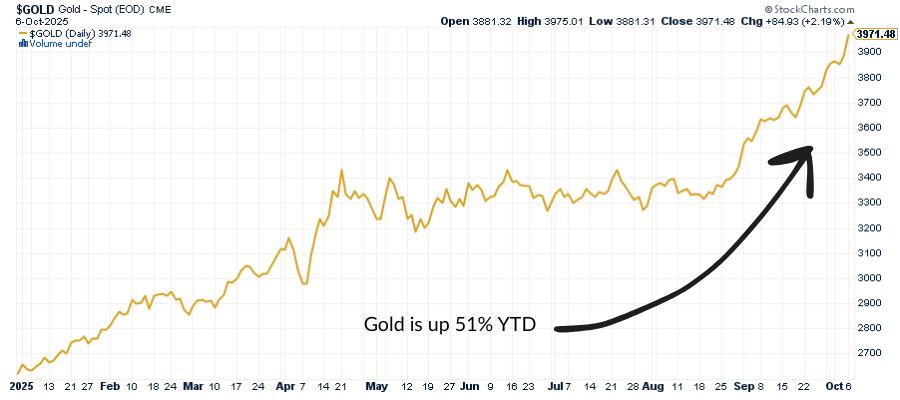

Looks like it’ll hit 4,000 this week. Crazy

And silver "should" hit 50 very soon too.

Ca...ching!

Maddog

★★★★★ Legendary Member

The World Is Using Silver Faster Than It Can Be Mined

Every 6.8 minutes, the world consumes as much silver as it takes miners 9.6 minutes to dig out of the ground.That imbalance can’t last forever. As Mike puts it, “Something has to give — and what has to give is price.”

Silver demand is relentless — from solar panels and electronics to industrial uses — and new supply just can’t keep up. The result? Eventually, the market will be forced to correct through much higher prices, or by industries becoming far more frugal with their use of silver.

Maddog

★★★★★ Legendary Member

Pulling a Lunk (ala Covid) with my gold/silver posts.

LOL

LOL

Maddog

★★★★★ Legendary Member

Daily News Nuggets | Today’s top stories for gold and silver investors

October 7th, 2025

Gold is now up more than 50% year-to-date, on pace for its best year since the 1970s. Silver has surged 67%, propelled by robust industrial demand and speculative inflows. With monetary policy expected to ease and inflation still stubborn, investors appear to be rotating from paper assets into tangible stores of value.

And as bullion breaks new ground, Wall Street’s biggest players are finally starting to chase the rally they once dismissed.

The upgrade joins a chorus of bullish calls, echoing Fidelity’s recent $4,000 projection. Both rest on the same premise: real interest rates are staying low while faith in fiat money continues to erode.

For months, markets have treated gold’s rise as a curiosity rather than a warning. But the scale of this move — and the institutional shift behind it — suggests investors are quietly preparing for a longer era of instability. And if the economy is as fragile as new private data implies, those fears may be well placed.

The Carlyle Group’s new proprietary model estimates just 17,000 jobs were created in September — far weaker than prior government trends suggested. ADP’s report shows a 32,000-job loss, while Revelio Labs estimates a modest gain, revealing how unclear the real picture has become.

These independent readings add weight to fears that the labor market is weaker than Washington admits. A softening jobs backdrop could force the Fed into deeper rate cuts — a setup that historically boosts gold as investors seek safety from policy missteps.

As confidence in official data falters, policymakers are turning their attention toward something far more tangible — control over real assets.

The Ambler project could become a cornerstone in America’s effort to secure its mineral supply chain and reduce dependence on China. Environmental groups warn of threats to fragile Arctic ecosystems, but for the administration, the calculus is strategic: access to resources equals leverage in a volatile world.

While new supply could pressure some industrial metals in the short run, the bigger picture is clear — nations are racing to secure physical commodities as trust in financial assets weakens. And while Washington shores up its own mineral supply, Beijing is quietly stockpiling the world’s oldest reserve asset.

This buying spree underscores a global shift in monetary strategy. Central banks — especially across Asia and the Global South — are hedging against dollar dependence and sanctions risk, moving steadily toward hard assets.

The direction of flow has reversed: what was once a westward “gold drain” in the 20th century is now a steady movement east. It’s not just a tactical trade — it’s a structural realignment of monetary power that could define the next financial era.

If 2025 has shown anything, it’s that gold is no longer the alternative — it’s becoming the anchor.

October 7th, 2025

Gold Rush Nears $4,000, Silver Approaching $50

Gold surged toward the $4,000 mark Tuesday, while silver climbed within striking distance of $50 as investors poured into precious metals amid mounting global uncertainty. Analysts cite a perfect mix of drivers — political volatility, weak U.S. data, and record central bank demand — fueling the move.

Gold is now up more than 50% year-to-date, on pace for its best year since the 1970s. Silver has surged 67%, propelled by robust industrial demand and speculative inflows. With monetary policy expected to ease and inflation still stubborn, investors appear to be rotating from paper assets into tangible stores of value.

And as bullion breaks new ground, Wall Street’s biggest players are finally starting to chase the rally they once dismissed.

Goldman Hikes December 2026 gold price forecast to $4,900

Goldman Sachs has lifted its 2026 gold target to $4,900 per ounce, citing persistent central bank buying, a weaker dollar, and slowing growth. The firm sees structural support for gold as investors diversify away from overvalued equities and long-duration bonds.The upgrade joins a chorus of bullish calls, echoing Fidelity’s recent $4,000 projection. Both rest on the same premise: real interest rates are staying low while faith in fiat money continues to erode.

For months, markets have treated gold’s rise as a curiosity rather than a warning. But the scale of this move — and the institutional shift behind it — suggests investors are quietly preparing for a longer era of instability. And if the economy is as fragile as new private data implies, those fears may be well placed.

Private Sector Steps In: Carlyle Tracks Weak U.S. Jobs Growth

After President Trump fired the head of the Bureau of Labor Statistics earlier this summer, skepticism about the accuracy of U.S. jobs data has only deepened. With the government still shut down and no official report available, private firms are stepping in to fill the void.The Carlyle Group’s new proprietary model estimates just 17,000 jobs were created in September — far weaker than prior government trends suggested. ADP’s report shows a 32,000-job loss, while Revelio Labs estimates a modest gain, revealing how unclear the real picture has become.

These independent readings add weight to fears that the labor market is weaker than Washington admits. A softening jobs backdrop could force the Fed into deeper rate cuts — a setup that historically boosts gold as investors seek safety from policy missteps.

As confidence in official data falters, policymakers are turning their attention toward something far more tangible — control over real assets.

Trump Greenlights Alaska Mining Push

President Trump has approved a long-disputed access road to Alaska’s Ambler mining district — a move to unlock domestic supplies of copper and other critical minerals. The executive order includes $35.6 million in U.S. funding for Canada’s Trilogy Metals, giving Washington a 10% stake and warrants for an additional 7.5%.The Ambler project could become a cornerstone in America’s effort to secure its mineral supply chain and reduce dependence on China. Environmental groups warn of threats to fragile Arctic ecosystems, but for the administration, the calculus is strategic: access to resources equals leverage in a volatile world.

While new supply could pressure some industrial metals in the short run, the bigger picture is clear — nations are racing to secure physical commodities as trust in financial assets weakens. And while Washington shores up its own mineral supply, Beijing is quietly stockpiling the world’s oldest reserve asset.

China’s Central Bank Extends Gold Buying Spree

China’s central bank increased its gold reserves for an 11th straight month in September, extending the longest accumulation streak in over a decade. The People’s Bank of China now holds more than 2,250 tons, solidifying its role as the world’s most consistent sovereign buyer.This buying spree underscores a global shift in monetary strategy. Central banks — especially across Asia and the Global South — are hedging against dollar dependence and sanctions risk, moving steadily toward hard assets.

The direction of flow has reversed: what was once a westward “gold drain” in the 20th century is now a steady movement east. It’s not just a tactical trade — it’s a structural realignment of monetary power that could define the next financial era.

If 2025 has shown anything, it’s that gold is no longer the alternative — it’s becoming the anchor.

Maddog

★★★★★ Legendary Member

If you’ve been waiting to stack more silver, now might be your last chance for a while. The global silver squeeze isn’t coming. It’s here.

In his latest video, Mike Maloney delivers a blunt warning: physical silver is vanishing worldwide, premiums are surging, and the disconnect between paper and physical markets is hitting a breaking point. From mints in Canada to shops in Vietnam, supply is drying up fast.

Even more concerning: in Vietnam, dealers report that raw materials themselves are running out. They can’t even get the metal to mint new coins.

In his latest video, Mike Maloney delivers a blunt warning: physical silver is vanishing worldwide, premiums are surging, and the disconnect between paper and physical markets is hitting a breaking point. From mints in Canada to shops in Vietnam, supply is drying up fast.

A Global Supply Shock in Real Time

Australia, Africa, Canada, Vietnam, the U.K., and the U.S. are all showing the same signs: empty shelves, delayed shipments, and backorders stretching out weeks. The Royal Canadian Mint and Perth Mint are both out of key products. SD Bullion had fewer than 2,300 units left at last count. And Costco? Zero silver or gold at any Ontario location.Even more concerning: in Vietnam, dealers report that raw materials themselves are running out. They can’t even get the metal to mint new coins.

Maddog

★★★★★ Legendary Member

The ETF Market Is Flashing Red

Silver ETFs like SLV are under massive pressure. Borrowing fees for short positions have exploded, with rates surging to nearly 10% and shares to short completely unavailable. That’s a huge red flag. As Mike explains, this signals intense behind-the-scenes stress and could fuel extreme volatility.At the same time, the paper price of silver is failing to reflect real-world scarcity. Mike shows how spot prices are diverging from the premiums paid for physical coins and bars. In some cases, buyers are paying $55+ per ounce—while spot lingers in the low $30s.

Buyers Are Not Waiting

The latest data from BullionStar is telling: for every seller in September, there were three buyers. Despite all-time highs in price, demand is not slowing. In fact, it’s accelerating. The message is clear: people want to own silver, not trade it.The global silver market is slipping into a scenario where “available” and “affordable” no longer mean the same thing. This is what happens when monetary metal meets monetary mayhem.

You can print dollars. You can’t print silver.

Maddog

★★★★★ Legendary Member

Similar threads

Recent Posts

-

David YT

- Latest: svnmag

-

Bis-Man Reel & Rec Ice Derby

- Latest: Honkerherms

-

YT Squirrel Dog

- Latest: svnmag

-

Crazy Wardens

- Latest: NodakBob

-

Spray foam on steel??

- Latest: 3Roosters

-

Buying gold and silver.

- Latest: 3Roosters

-

I HATE coyotes!!!!

- Latest: bucksnbears

-

OAHE Ice 25/26

- Latest: NodakBob

-

What are you listening to these days?

- Latest: svnmag

-

NFL News (Vikings)

- Latest: Kurtr

-

YT A Real Fisherman

- Latest: svnmag

-

Synthetic e fuels

- Latest: lunkerslayer

-

Online Poker

- Latest: Jiffy

-

Weather 6/20/25

- Latest: risingsun

-

Not Funny #2

- Latest: Davy Crockett

-

Outdoor photo request

- Latest: JMF

-

YT Trout Salad

- Latest: svnmag

-

Uncle Steve's Direction YT

- Latest: svnmag

-

Price of land just keeps going

- Latest: Traxion

-

YT Divorce Eggs

- Latest: Davy Crockett

-

Garmin

- Latest: SDMF

-

Stainless steel frying pans

- Latest: snow2

Friends of NDA

Top Posters of the Month

-

This month: 80

-

- Posts

- 4,692

-

- Likes

- 1,987

-

-

This month: 67

-

- Posts

- 2,940

-

- Likes

- 2,547

-

-

This month: 42

-

- Posts

- 1,424

-

- Likes

- 895

-