You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying gold and silver.

- Thread starter Sum1

- Start date

Fester

★★★★★ Legendary Member

I heard precious metals prices are up.

Anybody else hear that?

Anybody else hear that?

I hope you’re right!new all time highs

more to come

It wouldn't shock me to see another 25% by year's end. Time will tell.

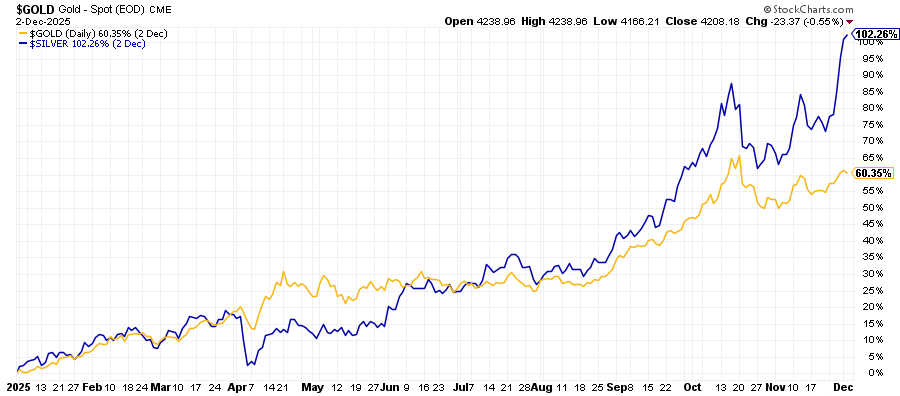

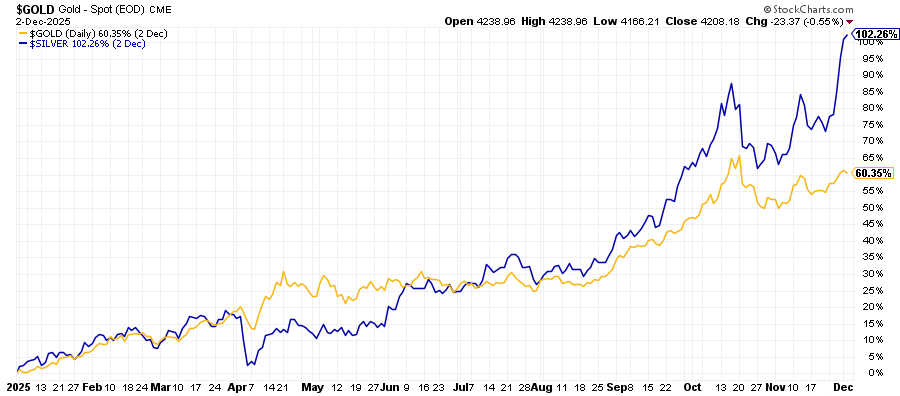

Not a great sign imo... people in the know are scaredSilver Reaches 100% Gains YTD

Silver just doubled. After opening 2025 at $28.92, it’s now trading at around $58.58 — a 100% gain with a month still left in the year.

Pheasant 54

★★★★★ Legendary Member

- Joined

- Nov 21, 2018

- Posts

- 651

- Likes

- 392

- Points

- 200

Have any of you tried explaining the price of precious metals to your elderly parents , mine are in their 90's ., They cannot wrap their head around the fact that a silver dollar is now really worth about 60 bucks . We had a single lady when I was a kid that on Christmas Eve gave silver dollars to kids at church as we left , Sure with I hadn't spent them at the 99 cent store

I'm smiling as I bought a bunch of Silver at $27.54 about a yr and a half ago. Bought some Gold at $2470 an ounce also. Kinda liking it.Silver Reaches 100% Gains YTD

Silver just doubled. After opening 2025 at $28.92, it’s now trading at around $58.58 — a 100% gain with a month still left in the year.

walleyeman_1875

★★★★ Legendary Member

At what point do you guys start to sell your gold and silver and take advantage of the massive gains? Or do you hang on to it forever and pass it on to you kids/grand kids.

For me personally, unless and until I need the money, I will just hold onto my holdings. Diversification.

Not sure this is entirely correct. Who the heck knows what my cost basis is/was if I paid in cash? I find it hard to believe how a person can be TAXED when the GOVT doesn't even know what a person paid for said commodity.

ForeverAt what point do you guys start to sell your gold and silver and take advantage of the massive gains? Or do you hang on to it forever and pass it on to you kids/grand kids.

Are talking about being taxed on gold you sell?Not sure this is entirely correct. Who the heck knows what my cost basis is/was if I paid in cash? I find it hard to believe how a person can be TAXED when the GOVT doesn't even know what a person paid for said commodity.

Pheasant 54

★★★★★ Legendary Member

- Joined

- Nov 21, 2018

- Posts

- 651

- Likes

- 392

- Points

- 200

You have to pay capital gains on it , if you don't know what you paid they will probably use the selling price for gold 14 years ago as your start point .My guess anyway

When it comes to owing taxes to the Gov the proof is entirely in your wheel houseNot sure this is entirely correct. Who the heck knows what my cost basis is/was if I paid in cash? I find it hard to believe how a person can be TAXED when the GOVT doesn't even know what a person paid for said commodity.

If inheriting, am I wrong to assume my son will get a stepped up cost basis at my death?When it comes to owing taxes to the Gov the proof is entirely in your wheel house

I believe that would only apply to capital gains tax not property tax. Capital gains tax will be based on appraised value at time of inheritance and at the sale of inherited property. If he sells the inherited property for the appraised value at time of inheritance or less he will not have any capital gains tax. The property tax will be on value assessed by the county.If inheriting, am I wrong to assume my son will get a stepped up cost basis at my death?

Anybody correct me if I am wrong on this.

EDIT - I thought I was answering on the property tax thread so ignore the mention of property tax.

Last edited:

Hope you are right as I will really be smiling!SILVER! Get on the train. Next stop $80/ OZ

Similar threads

Recent Posts

-

A.I. Are you Excited?

- Latest: Davy Crockett

-

What are you listening to these days?

- Latest: Rowdie

-

State of NDA

- Latest: svnmag

-

Big Horn

- Latest: svnmag

-

ATF Backdoor Gun Registry

- Latest: Eatsleeptrap

-

Olympics?

- Latest: Obi-Wan

-

Harwood ND AI business

- Latest: guywhofishes

-

gas can transfer pump

- Latest: johnr

-

Well, back to winter

- Latest: Maddog

-

GPS fencing for dogs

- Latest: chad.symington

-

NFL News (Vikings)

- Latest: lunkerslayer

-

I HATE coyotes!!!!

- Latest: Kurtr

-

POLITICS - WTF?

- Latest: lunkerslayer

-

Dire Wolves?

- Latest: Jiffy

-

RIP Robert Duvall

- Latest: risingsun

-

158 grain .38 Special SWC

- Latest: PrairieGhost

-

Fort Peck rescue

- Latest: lunkerslayer

-

Worm Rig YT

- Latest: svnmag

-

Bis-Man Reel & Rec Ice Derby

- Latest: Honkerherms

-

Boy would that be a sight

- Latest: lunkerslayer

-

2026 SCI RRV Banquet

- Latest: luvcatchingbass

-

Lab grown MEAT?

- Latest: Allen

-

Beef prices going up????

- Latest: Twitch

Friends of NDA

Top Posters of the Month

-

This month: 84

-

- Posts

- 4,834

-

- Likes

- 2,043

-

-

This month: 46

-

- Posts

- 1,507

-

- Likes

- 979

-

-

This month: 44

-

- Posts

- 3,026

-

- Likes

- 2,608

-