You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying gold and silver.

- Thread starter Sum1

- Start date

Maddog

★★★★★ Legendary Member

and if you would have held on to it yet. Gold is now over $4000I bought an ounce 15 years ago for around $800. Finally sold it the other day for $2233. Thats roughly 7% gains. That same $800 in my 401k would have been worth about $3300 with my current 10 year average return at 10%. However, I could have sold it a few years ago for just under $2k which would have increased the gains %.

Fester

★★★★★ Legendary Member

Maddog

★★★★★ Legendary Member

The Small Gold Bar Shortage Has Begun

In Tokyo, Japan’s largest bullion dealer, Tanaka Kikinzoku, just suspended sales of its 5-, 10-, and 20-gram gold bars. Lines stretched five hours long outside its Ginza store.Mike draws a historical parallel: this same pattern unfolded in 1980, when gold soared to record highs and buyers wrapped around city blocks, waiting for their chance to get in.

Once again, it’s happening — and not just in Japan. Retail investors worldwide are finding small bars harder to source, even as larger denominations remain available.

Central Banks Are Quietly Cornering the Market

While retail demand tightens, central banks are moving even faster. According to Mike, world central banks bought another 15 tons of gold in August, marking 27 months of net buying in the last 28.That’s not normal market behavior — that’s accumulation on an institutional scale.

Tether, the world’s largest stablecoin issuer, added 19 tons to its balance sheet in just the first half of 2025 — roughly equivalent to what China’s central bank purchased during the same period.

Gold is being removed from circulation, month after month, by entities that rarely sell.

Maddog

★★★★★ Legendary Member

Gold Hits $4,200 — Making 2025 One of the Strongest Years in Gold History

Just one year ago, gold traded at $2,660. Today, it’s officially crossed $4,200 per ounce, marking one of the fastest and most powerful rallies in modern history.The surge caps a 12-month run driven by central bank buying, global debt strains, and renewed fears over inflation and currency debasement. Traders are calling it a “new era” for gold as traditional models linking prices to real interest rates continue to break down.

Gold is now up about 58% year-over-year and 155% over the past three years — outperforming every major equity index in that span. With the Fed pivoting toward rate cuts and global confidence faltering, investors are increasingly treating gold not just as a hedge — but as a necessity.

Maddog

★★★★★ Legendary Member

Maddog

★★★★★ Legendary Member

new all time highs

more to come

It wouldn't shock me to see another 25% by year's end. Time will tell.

more to come

It wouldn't shock me to see another 25% by year's end. Time will tell.

I heard precious metals prices are up.

Anybody else hear that?

Anybody else hear that?

I hope you’re right!new all time highs

more to come

It wouldn't shock me to see another 25% by year's end. Time will tell.

Maddog

★★★★★ Legendary Member

“Boring” Gold Beats Nasdaq by 30% Over 5 Years

Daily News Nuggets | Today’s top stories for gold and silver investorsOctober 17th, 2025

Gold Quietly Outruns the Nasdaq Since 2020

Most people think of gold as the boring investment — it’s not as fun as bragging about the latest tech stock at a dinner party. But here’s the surprise: over the past five years, gold is up 129% versus 99% for the Nasdaq Composite.While megacap tech dominated headlines, gold quietly compounded with low correlation to equities and zero drama. In a cycle defined by rate shocks, bank scares, and geopolitical flare-ups, gold’s defensive bid didn’t just keep pace with high-flying tech — it beat it.

Start dates always matter and future returns aren’t guaranteed, but the message is clear: a strategic allocation to gold can carry more of the portfolio’s load than most investors expect. Even if it doesn’t make for exciting cocktail-party chatter.

Maddog

★★★★★ Legendary Member

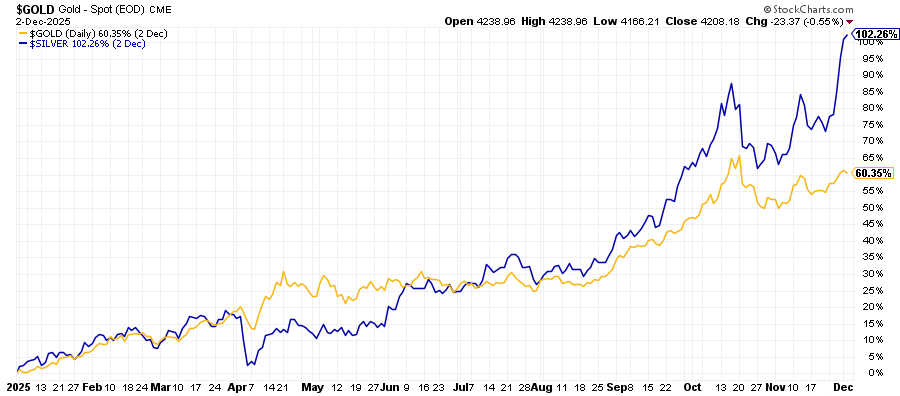

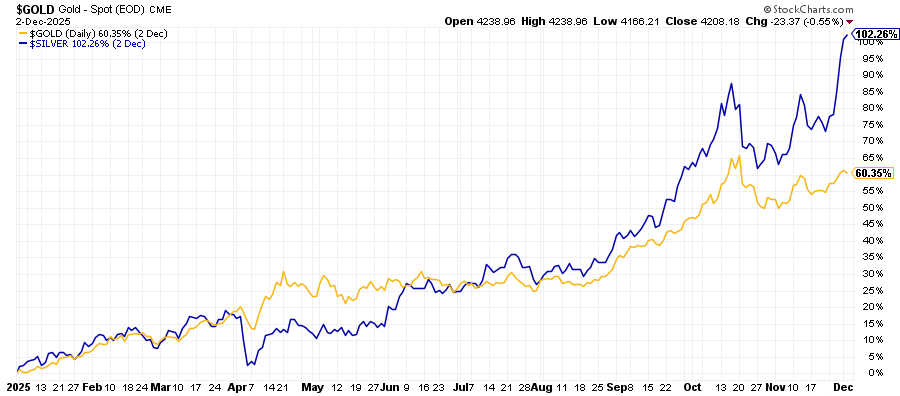

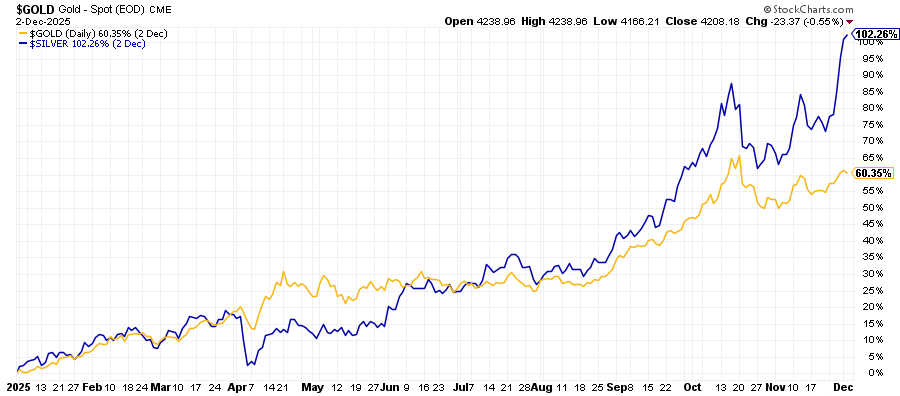

Silver Reaches 100% Gains YTD

Silver just doubled. After opening 2025 at $28.92, it’s now trading at around $58.58 — a 100% gain with a month still left in the year.

Not a great sign imo... people in the know are scaredSilver Reaches 100% Gains YTD

Silver just doubled. After opening 2025 at $28.92, it’s now trading at around $58.58 — a 100% gain with a month still left in the year.

Maddog

★★★★★ Legendary Member

I must not be in the know.Not a great sign imo... people in the know are scared

I don't even know what it is I should know.

So how should I know it?

(ala Rumsfield)

Pheasant 54

★★★★★ Legendary Member

- Joined

- Nov 21, 2018

- Posts

- 647

- Likes

- 383

- Points

- 200

Have any of you tried explaining the price of precious metals to your elderly parents , mine are in their 90's ., They cannot wrap their head around the fact that a silver dollar is now really worth about 60 bucks . We had a single lady when I was a kid that on Christmas Eve gave silver dollars to kids at church as we left , Sure with I hadn't spent them at the 99 cent store

I'm smiling as I bought a bunch of Silver at $27.54 about a yr and a half ago. Bought some Gold at $2470 an ounce also. Kinda liking it.Silver Reaches 100% Gains YTD

Silver just doubled. After opening 2025 at $28.92, it’s now trading at around $58.58 — a 100% gain with a month still left in the year.

Maddog

★★★★★ Legendary Member

YepI'm smiling as I bought a bunch of Silver at $27.54 about a yr and a half ago. Bought some Gold at $2470 an ounce also. Kinda liking it.

walleyeman_1875

★★★ Legendary Member

At what point do you guys start to sell your gold and silver and take advantage of the massive gains? Or do you hang on to it forever and pass it on to you kids/grand kids.

For me personally, unless and until I need the money, I will just hold onto my holdings. Diversification.

Maddog

★★★★★ Legendary Member

Good question. Personally, I am holding for now.At what point do you guys start to sell your gold and silver and take advantage of the massive gains? Or do you hang on to it forever and pass it on to you kids/grand kids.

I was fortunate to accumulate a lot of silver back when it was in the teens/ounce.

The largest gold purchase I did was at $1740/ounce. I was scared at the time. In hindsight I wish I had done 10x the amount.

Appreciate that there are tax implications with a sale. That is a taxable gain/loss.

To consider, if you bequest the gold/silver in your will, there is a new value for taxing (for the recipient) - the value of the gold/silver at the time of the bequest.

Appreciate that if you give the gold/silver away while you are living, the recipient is on the hook for the original purchased price of the asset NOT the value at the time of gifting.

The above is what I gleam from googling it. Hopefully that all is correct. Perhaps do your homework too.

<><>><><><>

IF silver goes through the roof like some predict, I may sell a large portion of my silver and then put the proceeds directly into gold. Not sure on that. ?

My thoughts is that silver may have a greater chance of higher, percentage appreciation. Driven by industrial/manufacturing uses.

If gold becomes the new backing for fiscal "money" it may blow away the silver gains. With current internet rumblings, it appears this has a high probability of happening too. I wouldn't be shocked at all.

Time will tell.

Short term I don't feel there is much risk in a major price correction. ?? Perhaps I am wrong.

I wish they could/would curtail the price manipulation that is going on. And has been, for years.

<><><>><>

If the Fed does the expected December rate cut, don't you too see the price of silver heading north of $60/ounce?

<><><

Diversify. : )

Since I sold all my gold stocks a couple of months ago, I have been "day trading" when I see trends. That is going "okay".

To me, the gold stocks are not such a hot commodity as they were in the first half of the year. That was easy money.

Not sure this is entirely correct. Who the heck knows what my cost basis is/was if I paid in cash? I find it hard to believe how a person can be TAXED when the GOVT doesn't even know what a person paid for said commodity.

Similar threads

Recent Posts

-

NFL News (Vikings)

- Latest: camper

-

A.I. Are you Excited?

- Latest: guywhofishes

-

Wood Planer?

- Latest: risingsun

-

I HATE coyotes!!!!

- Latest: SupressYourself

-

Model 12 Winchester

- Latest: NodakBob

-

Buying gold and silver.

- Latest: guywhofishes

-

Tire inflator

- Latest: ndfinfan

-

F 150 Owners

- Latest: 1lessdog

-

500,000 acre habitat program

- Latest: Migrator Man

-

The Decline of Devils Lake

- Latest: Rut2much

-

SnowDog

- Latest: lunkerslayer

-

Eat steak wear real fur

- Latest: lunkerslayer

-

Anyone see that one coming

- Latest: PrairieGhost

-

Rods From god YT

- Latest: svnmag

-

Heated jackets

- Latest: ndrivrrat

-

Seekins rifles

- Latest: lunkerslayer

-

Harwood ND AI business

- Latest: Davy Crockett

-

Ice fishing Sak

- Latest: Bcblazek

-

Polaris Ranger Windshield?

- Latest: ktm450

-

Packers

- Latest: Allen

-

Montana Snowpack

- Latest: svnmag

-

Bud Heavy

- Latest: Zogman

-

Oops

- Latest: NDSportsman

Friends of NDA

Top Posters of the Month

-

This month: 8

-

- Posts

- 4,758

-

- Likes

- 2,005

-

-

This month: 2

-

- Posts

- 4,012

-

- Likes

- 58

-

-

This month: 2

-

- Posts

- 2,775

-

- Likes

- 869

-

-

This month: 2

-

- Posts

- 2,984

-

- Likes

- 2,569

-