I live in the country. I don’t pay for the shit you listed. And I pay just as much in property taxes as they do. So why shouldn’t I pay the same as you and as those in small towns. And honestly there’s nothing that says property taxes pay for any of the shit. After the schools take I believe the majority of it goes back to the state. Then they send the morsels out to the peeons. When Williston bought that land for the airport they determined the value of that type of land. So why the hell shouldn’t all that type of land in that general vicinity be taxed at that value? What’s good for the goose is good for the gander. If we think property taxes are the best way to fund the states needs then the fair way is everybody pays a set amount per square foot. And no more tax exemptions for farmers homes. That’s absolute bullshit. How the hell are they some special class that should be given a free ride. Costs the county and townships a hell of a lot of money to keep up their roads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Property Tax discussion again

- Thread starter KJS - ND

- Start date

I think what your talking about are farmers primary residence in town.

No it is on the farm.

pretty confident it’s a state law. I’ll see if I can look it up.I think what your talking about are farmers primary residence in town.

No it is on the farm.

- - - Updated - - -

Def state law. Some changes made last session that appear is going to include some unintended consequences. Found this right away and doesn’t sound good to me.

https://www.google.com/amp/s/bismar...1ed47234-2c94-55ba-8a22-8302bf06c868.amp.html

Eye,

I am going by when we lived on our farm and i was Township Supervisor of course this was before my stroke so memory is somewhat foggy.

Anyway we had an outside firm come in to re-evaluate the farmsteads value. IF i REMEMBER correctly they only evaluated the farmsteads that people weren't actively farming. If their spouse worked off the farm they couldn't earn over a certain amount or their farmstead or house i can't remember which one it was would be taxed. If they were retired from farming they didn't have to pay the tax either. That is if after retirement they didn't go get a job working off the farm and earning over a certain amount.

I might have this somewhat screwed up so bear with me. I emailed our Tax Assesor to see what the scoop is back there.

I remember arguing with some as they were farmers and said they have a big investment. I would tell them what business owner doesn't have a big investment? Any other business owner has big investments in their business and they must pay taxes on their house. We had to pay on our farm house too.

I still feel that either all pay or none pay for their houses.

We have since sold the farmstead and cash rent the land out. The people that bought our farmstead rent our land so that is good for both parties.

I emailed our tax assessor back in Wells County to see what she says on this matter.

Will respond with what she says.

I see your post above and this is what i kind of remember.

I am going by when we lived on our farm and i was Township Supervisor of course this was before my stroke so memory is somewhat foggy.

Anyway we had an outside firm come in to re-evaluate the farmsteads value. IF i REMEMBER correctly they only evaluated the farmsteads that people weren't actively farming. If their spouse worked off the farm they couldn't earn over a certain amount or their farmstead or house i can't remember which one it was would be taxed. If they were retired from farming they didn't have to pay the tax either. That is if after retirement they didn't go get a job working off the farm and earning over a certain amount.

I might have this somewhat screwed up so bear with me. I emailed our Tax Assesor to see what the scoop is back there.

I remember arguing with some as they were farmers and said they have a big investment. I would tell them what business owner doesn't have a big investment? Any other business owner has big investments in their business and they must pay taxes on their house. We had to pay on our farm house too.

I still feel that either all pay or none pay for their houses.

We have since sold the farmstead and cash rent the land out. The people that bought our farmstead rent our land so that is good for both parties.

I emailed our tax assessor back in Wells County to see what she says on this matter.

Will respond with what she says.

I see your post above and this is what i kind of remember.

Last edited:

A lot of buildings own by farmers and ranchers on their farm do not qualify for tax exemption as you noted broken back but the local tax assors are not having the farmers/ranchers fill out the forms as they need to do to get that exemption.

We need to have a way to pay for all of this but the problem I feel with property tax it is not even close to being fair from one person to another. All depends on how some one values your property. db

We need to have a way to pay for all of this but the problem I feel with property tax it is not even close to being fair from one person to another. All depends on how some one values your property. db

Last edited:

Not sure if we are on the same page, First off the farm residence tax break is for the rich farmers , Us little guys have to work off the farm to make a decent living and if you work off the farm you make more income off the job that the farm and it disqualifies you for the tax break. The homestead credit is good for those that qualify for it but the way it's set up now there's no way we will qualify unless I divorce my wife and we just shack up.

Now onto taxes based on square footage , In town they plant your trees, Move snow so you can get to work in the morning , Provide parks , ball diamonds ,Soccer fields, water parks , provide and maintain walking trails and the list goes on.

Here I am on a 120 year old farm living in a 60 year old house and I am on the hook to provide all the things that a city provides for you so you will have a big job on your hands to convince me that I should pay the same taxes per Sq Ft as you do in town, You chose to live there pay your own damn taxes cuz I don't want to pay them either. lol

One thing I hope you never see is that farmers pasture land valued and taxed at the airport rate unless the city is in dire need to purchase it . That very thing happened right under your nose where retired people had to sell their property because they couldn't afford the taxes in Williston. I am pretty sure you cant just raise the value on farmland and force them off . Anyway, I'm not bitchen about my taxes, but I don't want to pay the same as the boys do in Fargo or what you must pay in Williston or I'd have to sell out , Force out just like the old people in Williston.

Looks like the legislator is picking winners and losers again by helping more farmers off the hook for property taxes. I hate property taxes but If one has to pay all should have to pay. So this guy sponsored and voted for property tax relief for himself but left others out.

"It was sponsored by a farmer, Sen. Jim Dotzenrod, D-Wyndmere. "

https://bismarcktribune.com/news/ag...cle_1ed47234-2c94-55ba-8a22-8302bf06c868.html

Last edited:

I basically posted the state on it. Counties have no choice in the matter. They do what the state tells them in this regard. The other thing that pisses me off is ag buildings are exempt from having to buy building permits. Have you seen the number of new big ass buildings they have put up? Most of them cost what a new home costs to build. And permits for new homes are around 2-2.5k depending on the price. So that’s tens of thousands of dollars the counties aren’t getting. The playing field has to be leveled. It’s assinine.

I basically posted the state on it. Counties have no choice in the matter. They do what the state tells them in this regard. The other thing that pisses me off is ag buildings are exempt from having to buy building permits. Have you seen the number of new big ass buildings they have put up? Most of them cost what a new home costs to build. And permits for new homes are around 2-2.5k depending on the price. So that’s tens of thousands of dollars the counties aren’t getting. The playing field has to be leveled. It’s assinine.

A lot of the farm buildings being put up are many times the cost of a new home. I have bid multiple building in the last few years in the 15,000 to 25,000 sq ft with prices well over a million dollars

See quite a few million dollar shops on the farms.

Some of problem is the lack of knowledge how property taxes work.

Had a farmer tell me their taxes pay for the school while mine in town only pay for the cities needs and contribute nothing towards the school.

There was a time the county, school would get the taxes off the windmills but it did not that long for the state to take those taxes for themselves.

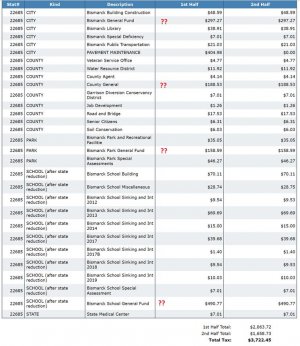

So here is what my taxes go to pay for versus land in the country and a place in town.

I own 2 acres in the country, tax is $5.53 with 2.80 to county, .16 township 2.54 to school and .03 to state.

Place in town is tax of $1020.71 with 331.95 to county, 419.51 to city, 329.64 to school, 75.40 to parks and 3.40 to state.

So correct what i have said wrong.

In town the city has never paid for a tree I planted but SCS does help plant trees on farm land and I could go on with what you said Davey.

As I stated some pay more than their fair share while other do not pay their fair share with this type of tax.

I have 40 acres of waste land with over half of it under water. Paid $2,000 for it and do use it for my plots and all that comes with it. Tax was less than $30 at purchase and is now at $185 with property same value as if it was farm land. Am working on getting that corrected.

Another guy told me he had no kids so he should not have to pay for my kids education and he was very upset about this. The list goes on and soon I will be shed hunting in Canada. db

there's a lot that needs to be corrected and in the end right now we are all being screw over.

Had a farmer tell me their taxes pay for the school while mine in town only pay for the cities needs and contribute nothing towards the school.

There was a time the county, school would get the taxes off the windmills but it did not that long for the state to take those taxes for themselves.

So here is what my taxes go to pay for versus land in the country and a place in town.

I own 2 acres in the country, tax is $5.53 with 2.80 to county, .16 township 2.54 to school and .03 to state.

Place in town is tax of $1020.71 with 331.95 to county, 419.51 to city, 329.64 to school, 75.40 to parks and 3.40 to state.

So correct what i have said wrong.

In town the city has never paid for a tree I planted but SCS does help plant trees on farm land and I could go on with what you said Davey.

As I stated some pay more than their fair share while other do not pay their fair share with this type of tax.

I have 40 acres of waste land with over half of it under water. Paid $2,000 for it and do use it for my plots and all that comes with it. Tax was less than $30 at purchase and is now at $185 with property same value as if it was farm land. Am working on getting that corrected.

Another guy told me he had no kids so he should not have to pay for my kids education and he was very upset about this. The list goes on and soon I will be shed hunting in Canada. db

there's a lot that needs to be corrected and in the end right now we are all being screw over.

Last edited:

THis just might be the single largest meeting of liberals I've ever seen on NODAK. Lots of proposals here to use other people to pay for stuff.

And for the love of all that is holy, drop the fugging "taxes mean I never own my property" bullcrap. That's basically been the rules of property ownership from the original invention of governments and the services they provide. Think of it this way, every single square inch of this nation belongs to the federal government, what you call "ownership" is nothing more than a license to use it to your benefit. If you think I am wrong, go ahead and try and sell your property to another country's government.

I don't like paying property taxes either, but I really don't like small communities having to go to the State every year to beg for the scraps that will be left over after places like Fargo, GF, Minot, BIsmarck, etc fight over the lion's share of the money.

I would rather see ND stand still in its growth. I like what I have and where I have it.

And for the love of all that is holy, drop the fugging "taxes mean I never own my property" bullcrap. That's basically been the rules of property ownership from the original invention of governments and the services they provide. Think of it this way, every single square inch of this nation belongs to the federal government, what you call "ownership" is nothing more than a license to use it to your benefit. If you think I am wrong, go ahead and try and sell your property to another country's government.

I don't like paying property taxes either, but I really don't like small communities having to go to the State every year to beg for the scraps that will be left over after places like Fargo, GF, Minot, BIsmarck, etc fight over the lion's share of the money.

I would rather see ND stand still in its growth. I like what I have and where I have it.

Allen,

I think the biggest problem some of us have with property taxes is the frivolous spending that our elected officials (mainly local) are doing. It is more prevalent, my opinion only, in our large cities. GF has 6 out of 7 persons on their council that will fund anything that their liberal friends bring forward. It is sad and extremely disappointing. Agree the state should help the small communities way more the the GF, Fargo, Bismarck and such. When the state gave so called tax relief back a few years ago it was just like a drunk fest for the big boys. I could go on and on but you get the picture.

I think the biggest problem some of us have with property taxes is the frivolous spending that our elected officials (mainly local) are doing. It is more prevalent, my opinion only, in our large cities. GF has 6 out of 7 persons on their council that will fund anything that their liberal friends bring forward. It is sad and extremely disappointing. Agree the state should help the small communities way more the the GF, Fargo, Bismarck and such. When the state gave so called tax relief back a few years ago it was just like a drunk fest for the big boys. I could go on and on but you get the picture.

Allen I agree that if the small towns had to go to Bismarck for monies there would be little left over after the big towns justify there share of the pot and how did that monies get in Bismarck in the first place. I am sure per capital it is more expenses to run in a rural setting versus where there are 1000.

Income tax, sales tax, property tax, gas tax or whatever tax there is no way that any kind of tax would be fair to everyone but we do need monies to pay for all of this. Maybe tax to all the rich to give to us poor ones. I guess I can decide who is rich or not just by looking at what they seem to have or where they have work. Maybe states could print there own monies for their needs. the federal government does it.

It seems sometimes are leaders have no ideal how to run a business like our government. No it is not to make a profit but to provide the services we need but it still needs to be run like a business and not just keep taxing for additional income for whatever.

This coming year due to retirement my income is a third of what it once was. Income tax the state will get out of me will be a fraction of what it once was. Same with monies I have to spent on stuff. Property tax I assume will go up.

But we have a system that I feel just needs to be refine to make it work better as after all these years we are still taxing the same way as always. db

Someone out there must have a plan to raise the monies that would result in everyone paying there, what is conceive as one's, fair share.

In all this time one would think a plan would of came up.

Hell I remember when my dad's cousin came and value personal property for the tax on personal property one had in their home back in the 50s. When he asked by dad how many guns and fishing rods he had my dad said the number and he put down one of each. Not sure what we kids slept on as there was only a couple of beds in the house.

Income tax, sales tax, property tax, gas tax or whatever tax there is no way that any kind of tax would be fair to everyone but we do need monies to pay for all of this. Maybe tax to all the rich to give to us poor ones. I guess I can decide who is rich or not just by looking at what they seem to have or where they have work. Maybe states could print there own monies for their needs. the federal government does it.

It seems sometimes are leaders have no ideal how to run a business like our government. No it is not to make a profit but to provide the services we need but it still needs to be run like a business and not just keep taxing for additional income for whatever.

This coming year due to retirement my income is a third of what it once was. Income tax the state will get out of me will be a fraction of what it once was. Same with monies I have to spent on stuff. Property tax I assume will go up.

But we have a system that I feel just needs to be refine to make it work better as after all these years we are still taxing the same way as always. db

Someone out there must have a plan to raise the monies that would result in everyone paying there, what is conceive as one's, fair share.

In all this time one would think a plan would of came up.

Hell I remember when my dad's cousin came and value personal property for the tax on personal property one had in their home back in the 50s. When he asked by dad how many guns and fishing rods he had my dad said the number and he put down one of each. Not sure what we kids slept on as there was only a couple of beds in the house.

Last edited:

I'm a little confused after reading all these posts again so lets just go in order-

1. Eyexer- if all 1500 square foot houses are taxed the same based just on square footage, why wouldn't each acre be taxed the same based on the same criteria? An acre is 43,560 ft sq all over ND so why are some taxed more than others?

2- Post after post about having the rich people pay to help us poor folks out? Sounds like a Bernie rally

3- Again for Eye, if you really have your tax statement from the county in front of you it lists very clearly how much goes to the state and its very little. Taxes are based on $ value. If you disagree on the valuation there are multiple ways to have it defended or adjusted. I am on several boards that levy mils and every year we have people who bring their statement and for the most part the county has made a mistake when they estimated the tax. Simple process.

4- Local funding for schools. Most of the posts have complained about the entrenched majority in bismarck. If we lose property taxes, raised locally, we also lose a voice in how those dollars are spent. Williston has voted down multiple options for new schools (shame on you for that by the way), but how do you think the folks in Pekin will feel now that the state is going to step in and build a school because the Williston people don't think they should have to pay for their own kids.

I have more but will cede the podium for now. TW

1. Eyexer- if all 1500 square foot houses are taxed the same based just on square footage, why wouldn't each acre be taxed the same based on the same criteria? An acre is 43,560 ft sq all over ND so why are some taxed more than others?

2- Post after post about having the rich people pay to help us poor folks out? Sounds like a Bernie rally

3- Again for Eye, if you really have your tax statement from the county in front of you it lists very clearly how much goes to the state and its very little. Taxes are based on $ value. If you disagree on the valuation there are multiple ways to have it defended or adjusted. I am on several boards that levy mils and every year we have people who bring their statement and for the most part the county has made a mistake when they estimated the tax. Simple process.

4- Local funding for schools. Most of the posts have complained about the entrenched majority in bismarck. If we lose property taxes, raised locally, we also lose a voice in how those dollars are spent. Williston has voted down multiple options for new schools (shame on you for that by the way), but how do you think the folks in Pekin will feel now that the state is going to step in and build a school because the Williston people don't think they should have to pay for their own kids.

I have more but will cede the podium for now. TW

I’m all for taxing every acre of farm land the same. Just like houses that’s the way it should be. In my post I said I didn’t recall for sure what amounts went to the state and upon looking the state gets very little. Yet the state has forced the counties to up their valuations. Makes no sense. And nowhere did I mention that I had an issue with my valuation. Not one time did I mention that. I simply said we need to drop the valuation method if we continue with property taxes. Simply tax solely on square footage. The same price per square foot on every house regardless where that house is. And I’m totally for taxing farm land the same per acre on every piece of ag land. This would streamline the shit out of the process and put an end to any debate about unfair valuations. It will also reduce labor immensely at the county level figuring valuations out on these properties. It would shrink government. But the best way is to eliminate property taxes altogetherI'm a little confused after reading all these posts again so lets just go in order-

1. Eyexer- if all 1500 square foot houses are taxed the same based just on square footage, why wouldn't each acre be taxed the same based on the same criteria? An acre is 43,560 ft sq all over ND so why are some taxed more than others?

2- Post after post about having the rich people pay to help us poor folks out? Sounds like a Bernie rally

3- Again for Eye, if you really have your tax statement from the county in front of you it lists very clearly how much goes to the state and its very little. Taxes are based on $ value. If you disagree on the valuation there are multiple ways to have it defended or adjusted. I am on several boards that levy mils and every year we have people who bring their statement and for the most part the county has made a mistake when they estimated the tax. Simple process.

4- Local funding for schools. Most of the posts have complained about the entrenched majority in bismarck. If we lose property taxes, raised locally, we also lose a voice in how those dollars are spent. Williston has voted down multiple options for new schools (shame on you for that by the way), but how do you think the folks in Pekin will feel now that the state is going to step in and build a school because the Williston people don't think they should have to pay for their own kids.

I have more but will cede the podium for now. TW

deleted member

Founding Member

Tax it on the value or whatever it is

Period. Home v home. Shop v shop. Business v business. And acre v acre. Maybe I am misunderstanding some posts. But,this square foot talk seems a bit silly.

Period. Home v home. Shop v shop. Business v business. And acre v acre. Maybe I am misunderstanding some posts. But,this square foot talk seems a bit silly.

Is garbage pickup included in your property tax in town or do you pay that separate ?

Similar threads

Recent Posts

-

Dice. Overpriced.

- Latest: risingsun

-

158 grain .38 Special SWC

- Latest: SDMF

-

ATF Backdoor Gun Registry

- Latest: Kurtr

-

Lake Darling

- Latest: Allen

-

Dog Help

- Latest: Kurtr

-

Harwood ND AI business

- Latest: Lycanthrope

-

Fort Peck rescue

- Latest: bigsky2

-

A.I. Are you Excited?

- Latest: Davy Crockett

-

OAHE Ice 25/26

- Latest: Rowdie

-

State of NDA

- Latest: snow2

-

What are you listening to these days?

- Latest: snow2

-

Worm/Swimbait Rig YT

- Latest: svnmag

-

Big Horn

- Latest: luvcatchingbass

-

Well, back to winter

- Latest: Maddog

-

GPS fencing for dogs

- Latest: snow2

-

Terry Steinwand Arrested GSI

- Latest: Obi-Wan

-

gas can transfer pump

- Latest: johnr

-

NFL News (Vikings)

- Latest: lunkerslayer

-

I HATE coyotes!!!!

- Latest: Kurtr

-

POLITICS - WTF?

- Latest: lunkerslayer

-

Dire Wolves?

- Latest: Jiffy

-

RIP Robert Duvall

- Latest: risingsun

Friends of NDA

Top Posters of the Month

-

This month: 95

-

- Posts

- 4,845

-

- Likes

- 2,045

-

-

This month: 54

-

- Posts

- 1,515

-

- Likes

- 984

-

-

This month: 44

-

- Posts

- 3,026

-

- Likes

- 2,609

-